Cardano-Based Decentralized Exchange SundaeSwap Off to Rocky Start

]

]

The congestion on the Cardano network is understandably frustrating, but also evidence of the network working as intended to live up to its mission of stability and economic fairness. The network didn’t crash, the security didn’t decrease, and it didn’t create exploitive fees for the end user. Instead, it is creating queues at various breakpoints throughout the system so that it can soak up and process as many orders as possible.

There were also some unanticipated issues with wallets, which we’re sure the developers at Nami, Blockfrost and ccVault are working diligently to resolve. We’ve been in contact with both Nami and ccVault to offer any support we can. It’s important to understand that we’ve seen no evidence of anyone’s funds being actually lost.

Finally, the DEX operates with a notion of slippage tolerance / acceptable price. Much like Uniswap or a classical exchange, the DEX is unable to execute an order outside of this price range in order to protect users funds. With each order moving the price, these orders would be outside the slippage tolerance regardless of how fast orders are processed.

We’re working diligently to investigate issues people are having, coordinating closely with the wallet developers to strategize around solutions and ultimately are very excited about the performance improvements coming to Cardano later this year.

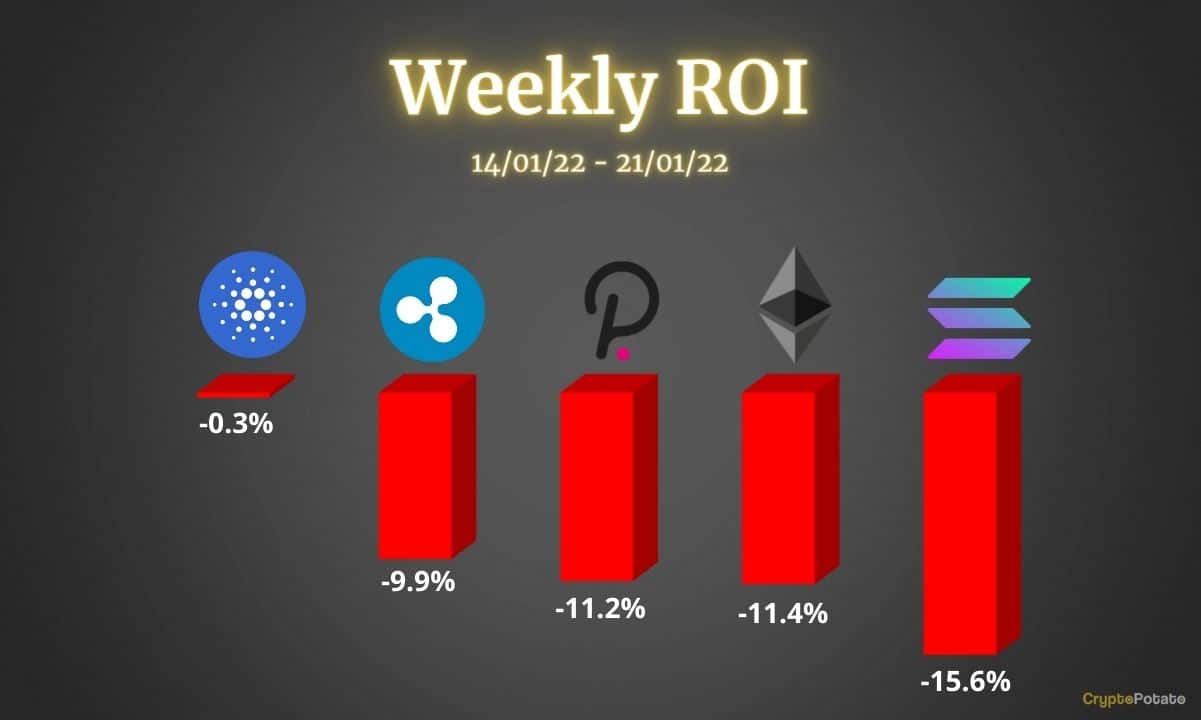

Crypto Price Analysis Jan-21: Ethereum, Ripple, Cardano, Solana, and Polkadot

]

]

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Polkadot.

Ethereum (ETH)

Last night, the significant market crash pushed ETH’s price under the critical support of $3,000, which will now act as resistance. Unfortunately, the loss of this crucial psychological level is a major blow to most market participants and sets the stage for ETH to potentially explore lower levels this year. Compared to seven days ago, ETH lost 11.4% of its dollar value.

The outlook on the market is very bearish, and one of the possible scenarios is for ETH’s price to rally and confirm the $3,000 level as resistance, after which the correction may continue. The current support is now found at $2,800 but appears weak.

Looking ahead, considering this latest breakdown in market structure, ETH has a good chance to fall lower in 2022. Targets such as $2,000 or below are now a very real possibility due to the current price action. The only way this can be avoided is if ETH reclaims the $3,000 level and turns it into support again.

Ripple (XRP)

XRP did not fare better after last night, losing the key support at $0.70, which is now being contested between bulls and bears. Overall, the cryptocurrency lost 9.9% of its price in the past week. The next key support level is found at $0.65 and may provide a short relief if the decline continues.

What is interesting to note about the XRP price action is that the drop yesterday was quite shallow if we compare it to BTC or ETH. This signals that the market already considers XRP to be at a significant discount. This may, of course, change in the future if the market remains bearish, but the bears were not as aggressive in this case.

Earlier this week, XRP gave some bullish signals, such as the higher lows on RSI and bullish MACD. However, due to this last drop in price, those signals have now been invalidated.

Cardano (ADA)

ADA’s price action this past week resembles a roller coaster with price volatility being off the charts. After it rallied to $1.6, the price dropped back to $1.2. These are swings exceeding 30% in a few days. The key support just above $1 has not been tested during this most recent drop, but it did push ADA to erase most of its recent gains. Overall, the cryptocurrency is back where it was last week.

The resistance above $1.5 will likely not be tested any time soon considering current market conditions and the indicators on ADA are quickly turning bearish. It would be interesting to see how it performs in the coming week if the market remains bearish.

Looking ahead, Cardano just saw the release of its first decentralized automated market maker called SundaeSwap, which seems to have had a very difficult rollout with transactions stuck and huge slippage. The creators warned that they may face bottlenecks on the network, but this does not seem to bode well for ADA holders.

Solana (SOL)

Yesterday night, SOL broke below the key support at $132, and the decline has temporarily stopped at the $120 level. However, this breakdown signals that SOL may fall to the next key support in the next few days found at $113.

The previous support has turned into resistance, and unless SOL moves above $132, it seems unlikely that this downtrend will end anytime soon. Overall, SOL had a terrible week, losing 15.6% of its value.

With this latest crash, the RSI has entered the oversold area (<30 points) on the daily timeframe, and the MACD did a bearish crossover. These are key signals that the bears have full control of the price action.

The overall picture for SOL is bleak, and the question is if it will manage to maintain a price level above $100. A failure there will signal a much deeper correction for SOL in 2022.

Polkadot (DOT)

DOT also lost its key support at $24, ending a long consolidation period within a large price range ($24 – $32) that started in December 2021. Now, the price appears set to test the next key support level at $20. Due to this most recent price action, DOT has lost 11.2% of its valuation in a week.

The resistance is found at $24, as former support levels turn into resistance during an indecisive market. The indicators also continue to signal a bearish price action.

The coming week may see a general bounce across the market, and DOT may retest the $24 level. It is, however, important to keep an eye on the bigger picture and not be lured into potential traps.

Cryptocurrencies Price Prediction: Sandbox, Solana & Cardano — Asian Wrap 17 Jan

]

]

Cardano price has seen a 26% ascent to $1.35 between January 10 and January 13. As ADA retests the $1.35 barrier for the fourth time, there could be a breakout, triggering another leg-up. A breakdown of the weekly support level at $1.20 could dent the bullish thesis.

Solana price has recovered above the $115.5 to $144.7 demand zone, signaling a bullish outlook. SOL consolidates above this area in preparation for a 15% rise to $174.3. A four-hour candlestick close below the $115.5 barrier will create a lower low, invalidating the bullish thesis.

Sandbox price sets up a platform for buyers to spark a bull rally. Interestingly, a crucial support level is present to facilitate the origins of such an outlook for SAND. Sandbox price left a demand zone, stretching from $4.21 to $4.77 as it surged nearly 23% between January 10 and January 12.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Coin Price Predictions for Solana, Cardano and Ethereum. All Set to Rebound After Recent Sell off.

]

]

Coin Price Predictions for Solana, Cardano and Ethereum. All Set to Rebound After Recent Sell off.

4.8 4 votes Article Rating

Coin Price Predictions: After struggling for weeks, Ethereum and Solana are set to rebound while Cardano which has already begun a bath of recovery may perform even better. x

Coin Price Prediction: Solana Stabilises After Steep Fall

Solana has seen a steep fall in past couple of months thanks to the loss harvesting by traders during the fag end of the year. It made a recent high of $ 259 on 6th November and since then it has tested a low of $130 on 10th January. Since then it is trying to stabilise over the past week, hovering between $157 and $130. Going forward, $130 is first support and if it breaks that level, $116 is very important level as it moved higher after testing $116 on 21st September. Also $157 is the first resistance and if it breaks on the higher side, $205 will act as the next zone of resistance.

Technically Solana is Sell from indicator’s perspective. It is below every moving average, be it simple and exponential considering both short term average like 10 days and long term averages like 100 days and 200 days. However, when we consider the shorter time frame like 30 minutes, it is regaining strength and it is a Buy considering moving averages as indicator. The daily pivot points for month of January lies at $187, and it can regain upward momentum if it decisively breaks this level with a big green candle.

The good news for Solana is JP Morgan commentary which states that Solana blockchain is capturing the Non Fungible Tokens (NFT) market share at the expense of Ethereum, whose share has dropped from 95% at the start of 2021 to 80% recently due to congestion and high gas fees. This news has given short term push to Solana and stopped it from further sell off as seen recently in other cryptocurrencies.

Read| Solana Price Prediction

Read| Solana Price Prediction 2022

Coin Price Prediction: Cardano Tests Important Technical Level. Major Move Ahead?

Cardano has given major heartbreaks to traders when it went up from $ 1.02 to $ 3.09 in a few weeks’ time from 20th July to 2nd September. Since then it has been in a direction downhill falling from $ 3.09 to $1.07 on 10th January. The Journey has been similar to other cryptocurrencies, testing multi month low at the end of the calendar year 2021. It has started to rebound after 10th January and after moving up by 50% to $1.59, it is hovering around $1.41 on 20.1.2022. Which important level lies at $ 1.41?

The daily pivot point for the month of January lies at $ 1.417 and if Cardano breaks it comfortably either upwards or downwards, one can start fresh buying/ selling as applicable. Although cryptocurrencies are very volatile, but pivot point do hold its importance and can trigger another big move in the following days.

The good news for Cardano is that at 10:08 UTC Cardano is up by 6.57% and has breached the pivot point comfortably. Also technically it is a Buy from moving averages perspective as it is above all the short and medium term averages ranging from 10 days to 50 days. Also MACD (12,26) with Momentum (10) is indicating a Buy signal indicating the recently developed push post 10th January.

It is very important to note that $1.07 is very important support going forward as coin has reversed from downward journey from $1.07 twice, on 20th July 2021 and 10th January 2022. Also $1.59 is the next resistance post $1.41 and if it breaks comfortably towards upside, then $1.75 is the next resistance. $2.37 can be the target in coming months if it sustains the upside movement.

Cardano is positioned very well from technical perspective to give a big move in coming weeks and it has started on positive note post 10th January, now it is wait and watch situation before it sustains the breakout of the pivot level.

Read|Cardano Price Prediction

Read| Cardano Price Prediction 2022

Coin Price Prediction: Ethereum is Expected to Test $2650 in Upcoming days?

Ethereum has a robust blockchain support smart contracts and NFTs. However, its journey over the past year has been volatiles as it rose from $1718 to $4868 in a span of less than four months between July to November. It has since fallen to September 2021 level of $3250. Currently it is trading with a positive bias and is keen to test 200 EMA level of $3473. Currently it is trading at $3256 at 10:56 UTC on 20.1.2022 and is hovering between $3000 and $3400.

But, from a technical perspective, investors should press Sell button as it is trading below all the moving averages, simple and exponential and other indicators like MACD (12,26), RSI (14) are all neutral and it cautions us before entering Ethereum at this level. Add to it, the commentary of JP Morgan not favouring Ethereum in terms of NFT and its market falling from 95% to 80% due to congestion and high gas fees.

Going forward, $3000 will act as first support and if it breaks that then $2640 will act as strong support as it bounced back from this level on 21st September. 200 days EMA of $3473 is first resistance and if it breaks decisively this level then, 200 days SMA of $4026 will act as strong resistance. Also, Ethereum is backed by strong community support and it is expected to rebound anytime soon along with other cryptocurrencies given that recent negative commentary does not garnish negative sentiments for a longer duration.

Read|Ethereum Price Prediction

Read|Ethereum Price Prediction 2022

-Vineet Agarwal

Note: Crowdwisdom360 collates Predictions and data from all over the net and has no in-house view on the likely trends in the Index or Individual Stocks. Please consult a registered investment advisor to guide you on your financial decisions.

Not Bitcoin or ether, why these crypto tokens should be on your radar this year

The world’s largest cryptocurrencies such as Bitcoin, ether have been declining in the past few days, hit by investors weakening sentiment. Amid the volatility and popularity, crypto experts see the following tokens that one can watch out for this year.

“The bullish scenario is that this is the accumulation phase and the market is only going sideways and is just waiting for a spark to start a new ride. On the other hand, in the bearish scenario, many analysts think that the market is losing support and might start a new signal," said Sathvik Vishwanath CEO, Unocoin.

Solana

“Profoundly called the ‘Ethereum Killer’, This Scalable Proof of Stake-cum-Proof of History Blockchain made its mark in the space in just over 2 years. The tangible ground upon which Solana worked its way to the top enabled 65,000 Transactions per Second making Solana the fastest cryptocurrency to date along with a transaction finality of 13 seconds,” highlighted Aayush Sharma, Co-founder, TechPay.

As per Melbin Thomas, Co-founder, Sahicoin, its fast processing time and lower fees make Solana a loveable infrastructure. More than 400 projects are being constructed on Solana. “Solana is in the golden ration zone (61.8%) as per fib retracement. The token is at a strong support zone and can see a range between $115 to 130 before going for a high again."

“Solana has been going multiple lower lows and failing to break the resistance. Currently in the daily candle charts, if the bulls can push and break 20 days EMA at $149.82, there is a high chance it will hit $163 of 40 days MA. The RSI is showing a good signal for buyers at below 40. Countering the bulls if the bears push down to support at $133, can be a bad picture for SOLUSD,” suggested Unocoin’s Vishwanath.

Cardano

“Capable of processing 257 transactions per second accompanied by transaction finality time of around 5-10 minutes, Cardano price has been developing because of the expected bullish increment with inside the coming days which lead to many buying $ADA,” said TechPay’s Sharma.

“The most interesting crypto to watch out for right now is undoubtedly Cardano. The news around the launch of SundaeSwap: a decentralized trading protocol on Cardano blockchain is going out, it is most likely going to be an uptrend for ADAUSD,” as per Vishwanath.

Theta

“Theta is a web 3 video sharing protocol. It is disrupting the video streaming space currently dominated by YouTube in web 2. Theta is building a creator driven economy where creators are rewarded with Theta token for their contribution to the platform,” said Melbin Thomas, Co-founder, Sahicoin.

Fantom

Fantom is a smart contract platform that intends to solve the scalability issues of existing public distributed ledger technologies. It is a Layer 1 infrastructure just like ethereum.

“The mission of Fantom is to make it easier to transact across multiple blockchains, and create an ecosystem which allows real-time transactions and data sharing at a low cost. Fantom also has one of the strongest communities in the crypto ecosystem," Sahicoin’s Thomas highlighted.

The views provided here are only for informational purposes and should not be taken as financial advice.

Subscribe to Mint Newsletters * Enter a valid email * Thank you for subscribing to our newsletter.

Never miss a story! Stay connected and informed with Mint. Download our App Now!!

Topics