Today’s news in 10 minutes

]

]

Story highlights This page includes the show Transcript

January 25, 2022

A violent crime wave rises in U.S. cities from coast to coast. The U.S. tells non-essential personnel to leave its embassy in Ukraine. A European astronaut discusses how some lessons learned on the International Space Station could be applied on Earth. And a photographer captures “ice pancakes” on Lake Michigan.

CNN 10 serves a growing audience interested in compact on-demand news broadcasts ideal for explanation seekers on the go or in the classroom. The show’s priority is to identify stories of international significance and then clearly describe why they’re making news, who is affected, and how the events fit into a complex, international society.

Thank you for using CNN 10

Stocks finish lower, dashing hopes for a turnaround Tuesday

]

]

New York (CNN Business) Investors better fasten their seat belts because there’s no sign of volatility letting up on Wall Street.

Stocks resumed their selloff for most of day, but the Dow offered a glimmer of hope for turnaround Tuesday when it briefly turned green in the afternoon.

But even though stocks ended off their lows, the major indexes all ended in the red.

Thefinished a moderate 0.2% or 67 points lower, having swung more than 1,000 points from high to low-point for the second straight session in a row.

Dow componentsandall posted strong outlooks in their earnings releases, helping lead the index back from its worst losses.

S&P 500 SPX Thefinished down 1.2% but again avoided the dreaded correction territory, defined as a 10% drop from the most recent peak. In the case of the S&P, that was just three weeks ago, when it hit a record high on January 3

Nasdaq Composite COMP The, which fell into correction territory last week, closed down 2.3%.

CBOE Volatility Index VIX , CNN Business’ The market’s volatility tracker, the, or Vix, also reflected the roller coaster-nature of the day and ended up 2.2%, having recovered from its earlier double-digit percentage jump. Amid all thisCNN Business’ Fear and Greed Index fell solidly into “fear” mode Tuesday, as investors grew worried about the Fed’s policy changes and global politics.

Stocks climbed almost unabated in 2021, and some experts believe the market was due for a pull-back as stocks got expensive. On Monday, the Dow fell more than 1,000 points at its lowest point but finished in the green thanks to a last minute reversal just before the market closed

“Recent price action suggests the long overdue equity market correction has finally begun. In our view, this is a healthy long-term development,” said Steven Ricchiuto, US chief economist at Mizuho Securities.

For value hunters, the recent selloffs might present an opportunity “to begin nibbling at some of the more beaten down areas of the market,” he added.

What’s driving markets

Investors have a lot on their plate right now.

The Federal Reserve’s meeting is kicking off ahead of Wednesday’s policy decision. Although Fed Chairman Jerome Powell hasn’t made a secret of the central bank’s plans to roll back stimulus and raise interest rates this year, it’s stressing investors out.

The central bank in December signaled multiple rate hikes in 2022 and expectations settled on three one-quarter percentage point increases. But since then, the market has shifted its expectations to as many as four hikes.

Treasury bond yields, which track interest rate expectations, ticked higher on Tuesday, with the 10-year bond yielding 1.79% at the time of the stock market close. Last week, the yield had climbed above 1.8% for the first time since the pandemic started, signaling that the market is gearing up for a rising interest rate world.

The Fed’s expected actions come in response to rampant pandemic-era inflation. Economists and investors worry when will prices have soared so much that Americans stop spending – a terrible sign for the recovery.

Consumer confidence fell slightly in January, data from The Conference Board showed Tuesday, but it was still better than economists had expected. American’s view of the present situation improved even though short-term growth expectations declined.

“Concerns about inflation declined for the second straight month, but remain elevated after hitting a 13-year high in November 2021,” said Lynn Franco, senior director of economic indicators at The Conference Board. “Concerns about the pandemic increased slightly, amid the ongoing Omicron surge.”

With earnings season in full swing, investors want to hear how much of the production price increases companies can pass onto their consumers.

Why Biden should be worried about the stock market

]

]

New York (CNN Business) President Joe Biden’s honeymoon with the stock market is over.

The Nasdaq, despite its historic rebound on Monday , finished sharply lower on Tuesday and is on track for its worst month since 2008 and its worst January ever.

It bears reminding ourselves that the stock market is not the economy . The fact that high-flying tech stocks on Wall Street have succumbed to gravity doesn’t change the facts that unemployment is very low , demand for workers is high and wages are rising.

Yet this is not merely a Wall Street problem. Main Street would be threatened by a more serious market downturn, and that would spell political trouble for Biden, whose approval ratings have been hurt by very high inflation.

“The economy and markets are intertwined. A sharp drop in the stock market will impact economic activity. They are all in the same bed together,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group.

The risk is that the market’s turmoil spills over into the real economy, erasing trillions of dollars in household wealth.

Moreover, further losses on Wall Street threaten to dent already shaky confidence among consumers, who have more exposure to stocks than they used to. If your nest egg just got 20% smaller, do you hold off on booking that vacation? Or buying a new car (assuming you can find one )? Maybe so.

“There is a real threat to Main Street. The Fed is trying to raise rates to ease inflation, but not choke off economic growth. It’s a very fine balance,” said Kristina Hooper, chief global market strategist at Invesco.

At the same time, market stress can make it harder for companies to raise money in capital markets that had been wide-open until very recently.

“A sustained selloff in the stock market starts to catch people’s attention and does affect confidence over time,” said Ethan Harris, head of global economics at Bank of America. “The average person judges the economy by a few statistics. One of them is the Dow Jones Industrial Average.”

Americans are more exposed to market turmoil today

It’s true that the fortunes of the rich are more closely tied to the stock market than the middle class, whose wealth is linked more to home values, which are way up during Covid.

The richest 10% of US households held a staggering 88% of all corporate stock and mutual fund wealth as of the third quarter of last year, according to the Federal Reserve.

Yet stocks represent a greater chunk of the average American’s net worth than they used to.

Households in the 50% to 90% wealth range held $4.3 trillion in stocks and mutual funds as of last year, representing 9.4% of their net worth, according to the Fed. That’s up from just $1.6 trillion and 6.4% a decade ago. In 1991, stocks made up just 4.7% of this group’s wealth.

Likewise, the bottom 50% of US households held $260 billion in stocks and mutual funds, comprising 2.9% of their wealth. That’s up from $90 billion and 1.8% of their wealth a decade ago.

Asked about the recent market drop, a White House official told CNN the administration focuses on trends in the economy, not any single indicator. The official pointed to “real progress” demonstrated by the 3.9% unemployment rate and jobless claims that have declined by about two-thirds from a year ago, when the unemployment rate was 6.4%.

“Unlike his predecessor, President Biden does not look at the stock market as a means by which to judge the economy,” the White House official said, alluding to former President Donald Trump’s well-chronicled obsession with the Dow as the ultimate barometer of economic success.

Economists are on high alert for signs that the stock market stress is infecting the broader capital markets that keep the economy humming.

Yields in the junk bond market have begun to creep higher. A spike would make it more expensive or impractical for leveraged companies to refinance their debt. And that would have a real and immediate economic impact.

Markets have been ‘quite complacent’

The good news is that stocks haven’t yet fallen sharply enough to alarm economists.

The S&P 500 is flirting with a 10% correction from prior highs. Such drops are viewed as healthy after sharp rallies.

“What would make us nervous would be a 15% to 20% drop in markets that is sustained,” said Bank of America’s Harris.

The S&P 500 is nowhere near the 20% threshold required to be considered a bear market, although the Nasdaq got close to that on Monday before rebounding.

“We’ve got a long way to go. I don’t think it’s impossible though,” said Harris. “Clearly, the markets have been quite complacent about the Fed. And the Fed has contributed to that by downplaying the risks and describing inflation as transitory.”

The market stress began earlier this month after the minutes from the December Fed meeting revealed officials are stepping up their efforts to fight inflation by removing the easy-money punch bowl that has juiced the stock market.

That did not set well with investors, who have become accustomed to unprecedented support from the Fed. Near-zero rates, combined with massive Fed purchases of bonds, forced investors to bet on risky assets like stocks. Now, the reverse is happening.

“The Fed is in an impossible spot, one that they put themselves in,” said Boockvar. “They are the architects of this relationship. Now they have to deal with the so-called break-up.”

Soaring tensions between Russia and Ukraine have only added to the stress on Wall Street.

Why the Fed isn’t freaking out

Fed officials, gathering for this week’s regularly scheduled policy meeting, are likely not freaking out about the market turmoil. At least not yet.

Mark Zandi, chief economist at Moody’s Analytics, said the market retreat is a feature, not a bug, of the Fed’s shift to inflation-fighting mode.

“So far, I view this as therapeutic,” Zandi told CNN. “The Federal Reserve wants and needs the economy to cool off, otherwise it will blow past full employment and inflation will become a persistent problem.”

Keep in mind that the Fed regularly speeds up and slows down the real economy in large part by influencing financial markets. Lowering rates supports growth by making it easy to borrow and boosting risky assets. And vice versa.

Despite the recent losses, markets remain significantly higher during the Covid era. Even at Monday’s intraday low of 4,222, the S&P 500 was trading 93% above its low in March 2020 when the nation began shutting down.

To be sure, stocks can’t go straight up forever. A recalibration makes sense given the Fed’s shift in its policy.

“The market got ahead of itself. It got overvalued, bordering on frothy,” said Zandi. “As rates rise, bubbles are coming out.” But he added that a 20% to 25% decline in stocks would become more problematic for the real economy.

“That could cause damage that you don’t want to see,” Zandi aded. “It’s tricky because the market can take on a life of its own.”

First on CNN: Bank of America is giving workers $1 billion of stock

]

]

New York (CNN Business) Bank of America is handing out $1 billion worth of restricted stock to virtually its entire workforce as the bank seeks to gain an upper hand in the war for talent.

In a memo shared exclusively with CNN, Bank of America CEO Brian Moynihan said Tuesday the company is for the first time opening up its stock awards program to lower-level employees who make up to $100,000 a year. In the past, those employees received a one-time cash bonus.

Bank of America BAC said each eligible employee will receive between 65 and 600 restricted stock units, corresponding with their compensation. Those units will vest over four years beginning in 2023.

At a minimum, that means frontline workers like bank tellers will receive restricted shares that are valued, on paper, at about $2,900 based on Bank of America’s current share price of $45.

At the upper end, higher-salary employees would get restricted shares valued at around $27,000.

Read More

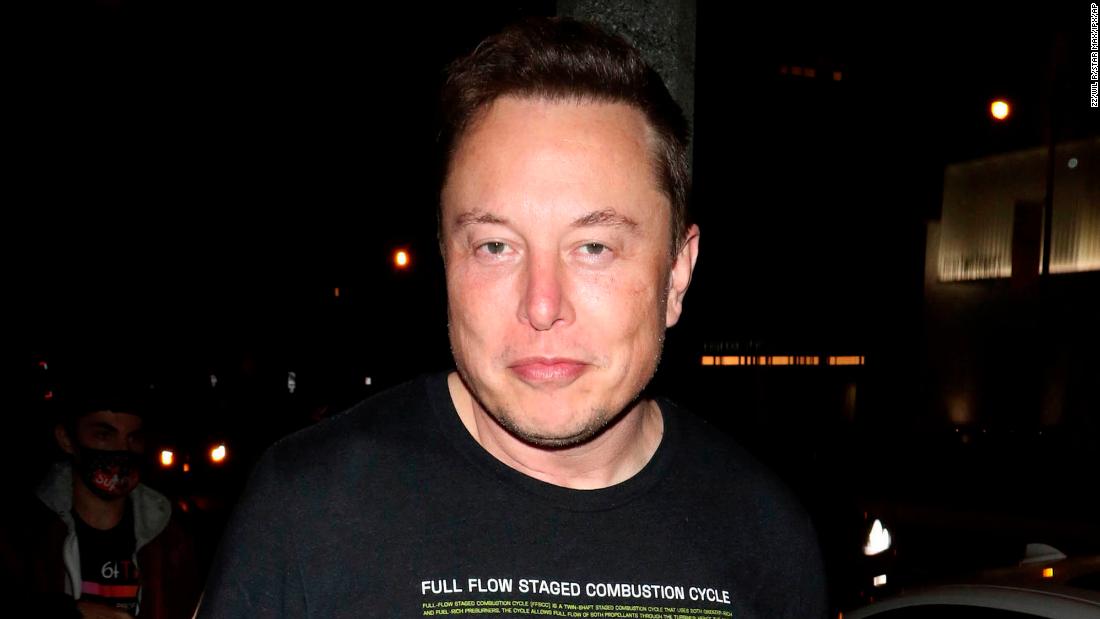

Elon Musk is about to get a lot richer

]

]

New York (CNN Business) It’s been a rough start to 2022 for the world’s richest person. He’s not too worried, though.

Musk doesn’t receive any base salary or cash bonus from Tesla. Instead, he receives stock options based on the company hitting certain financial and market value targets. His 2018 pay package allocated 101 million split-adjusted shares that would be awarded to Musk in 12 equal tranches, as the company hit those benchmarks.

The market value benchmarks have all been achieved, even though Tesla’s recent slide has removed it from the list of companies with a trillion-dollar market cap . And seven of the financial targets have been hit so far, with two being reached in 2019, two more in 2020, and three in the first nine months of 2021. So he’s already received 59 million of the 101 million options in that package.

Analysts expect Tesla to hit the remaining five financial targets this year to give Musk all the options he possibly could get under that 2018 package. If they’re right, he’ll qualify for four of the tranches this year – a record for him – and one more in early 2023 once fourth quarter 2022 results are officially in the books.

“With Tesla’s growth trajectory, I’d be surprised if he doesn’t get all five tranches this year based on hitting all the triggers,” said Dan Ives, tech analyst for Wedbush Securities.

Each of the tranches of options would give him the right to purchase 8.4 million shares of stock for the bargain price of $70.01 a share – the price of the stock when the options were first granted in 2018. At Monday’s closing price of $930, that means each tranche of options would be worth $7.3 billion, and all five tranches would total $36.3 billion.

He’s very likely to qualify for at least one tranche of options, perhaps two, when Tesla reports fourth-quarter results on Wednesday. He should have at least three tranches in hand once the first-quarter results are reported in April, and a fourth tranche by mid-year.

A big tax bill … in 2027

However many options Musk receives in the next 12 months, he probably won’t have to pay any taxes on them for about five years. That’s because he’ll only have to pay taxes on the options once he exercises the options and buys additional shares. And he’s only likely to do that when the options are about to expire.

These latest options won’t expire until January 2028, so he probably won’t exercise them until 2027. He hasn’t yet had to pay taxes on the 59 million options he’s already received as part of that 2018 pay package. And he likely won’t be paying taxes on any of the 42 million additional options he is likely to receive over the course of the next 12 months, no matter how much they are worth.

Sinking stock

The biggest problem for Musk is that Tesla shares are having a particularly bad year. He owns 177.7 million shares, in addition to the options he already holds to buy an additional 59 million shares. That’s the reason for the massive hit to his net worth in 2022. Still, Forbes’ real time billionaire tracker puts Musk’s net worth at $241 billion.

Investors have grown worried about riskier tech stocks, such as Tesla, as the Federal Reserve moves to quash inflation with higher rates and less stimulus. Tesla is worth more than the 10 largest automakers in the world despite posting significantly smaller sales than each of them. That makes it the poster child for a stock with a questionable valuation.

“As you’re seeing investors heading for the hills on risk, Tesla shares are caught in storm,” said Ives.

During a deep sell-off in US stocks on Monday, Tesla shares were down as much as 10% for the day at one point. But they rallied back along with the rest of the market to close down only 1.5%. Still, that was enough to shave $3.3 billion off of Musk’s net worth.

Many analysts see the recent slide in Tesla shares as a temporary setback. Tesla shares reversed a similar slide in early 2021 to end the year up 50%. Of analysts surveyed by Refinitiv, 18 have a buy or strong buy recommendation on the shares, compared to 10 with a sell or strong sell recommendation.

Ford F Ives said the recent sell-off in Tesla shares, down 25% since its record high in early November, makes Wednesday’s earnings report particularly important for investors. They’ll want more information about plans to ramp up production at two new factories and when it plans to roll out the Cybertruck, its pickup truck, which will be facing competition from pickups offered by established automakers likeand an upstart EV maker, Rivian

A disappointing report could feed into the sell-off, while a strong earnings report could turn around shares, Ives said.

“We think strong Tesla earnings could be a life raft for its shares,” he said.